BOK Asaan Current account offers a host of free banking services with no restriction on number of transactions. It also provides complete peace of mind with easy account opening procedure and is tailored for all low income unbanked/under-banked masses that face difficulties in account opening.

- Account can be opened with minimum of Rs.100.

- Account can be opened as individual, joint or minor type.

- Account can be opened with minimum formalities and on one pager account opening form.

- There is no minimum balance requirement, no account maintaining charges.

- The account will preferably be Debit Card based. However, cheque book may be issued as per choice of the customer.

- Free 1st 25 leaf Cheque Book.

- Free online banking.

- SMS Alerts service is available as per Bank Schedule of Charges.

- Per month total Debit limit and total Credit Balance limit is Rs. 500,000.

- Account can be converted into normal current account after completion of remaining formalities if later on, accountholder requires financial services for higher amounts than the above specified limits.

- Free Internet banking facility.

- Free of Cost Utility Bills payment facility through BOK ATM Network.

- Terms and conditions apply.

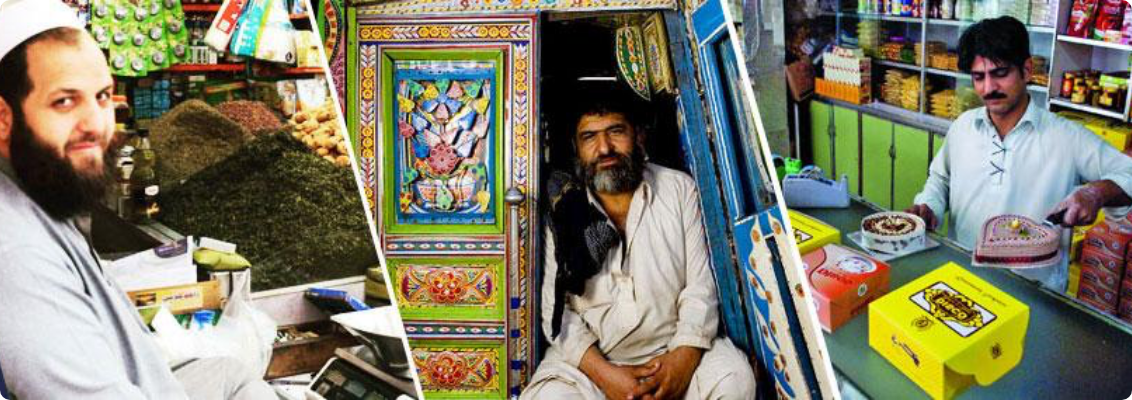

The segments of society that may include but are not limited to skilled/unskilled work force, farmers, less educated/uneducated people, laborers/daily wagers, women/housewives, self-employed individuals, pensioners, young adult population, students, Zakat Mustahiqeen, widows, salaried persons, benevolent fund grants etc are eligible to open BOK Asaan Current Account